Hatsek - A Better Way To Send Money Across Borders

Sending funds to someone living far away, across different countries, often feels like a chore, doesn't it? It's a bit like trying to send a letter through a very long, twisty pipe, and then finding out you've been charged a surprising amount just for the privilege. Many folks have felt that pinch, seeing a chunk of their hard-earned money disappear into fees when all they wanted was to help out a loved one or pay for something important. This old way of moving money around the world, it often comes with a lot of hidden costs and a fair bit of waiting, which can be really frustrating, you know?

But what if there was a simpler path? A way that felt less like a financial puzzle and more like a quick chat with a friend? That's where the idea of 'hatsek' comes into play, offering a fresh perspective on how we handle money across different places. It's about making those overseas money transfers feel easy, truly, and also very quick, without all the usual fuss. Think of it as a helpful hand, guiding your money where it needs to go without unnecessary delays or those unwelcome surprises when you check your statement.

This 'hatsek' approach aims to reshape how we think about moving money, not just making it simpler for individuals, but also for businesses looking to connect on a bigger scale. It's about being able to send and get payments in many different types of money, so you can truly feel global, you see. This way, whether you're dealing with a small sum or a much larger one, the process doesn't have to be a big headache. It's about finding a better path, one that lets you keep more of your money and gives you peace of mind.

Table of Contents

- What's the Big Deal About Moving Money Globally?

- The Frustration Before Hatsek

- How Does Hatsek Make Things Easier?

- Getting Paid Without the Hassle of Hatsek

- Can Hatsek Really Save You Money?

- The Smart Savings with Hatsek

- What's Next for Hatsek and Global Connections?

- Looking Ahead with Hatsek

What's the Big Deal About Moving Money Globally?

You know, for a long time, sending money across borders has been, well, a bit of a pain. It's almost as if the traditional financial places enjoyed making it difficult, or at least, that's how it felt to many of us. These older systems, they typically put a lot of extra charges on top of your overseas transfers. It's like you're trying to send a package, and then they add a bunch of unexpected fees just for crossing a line on a map. This can eat into the money you're trying to send, which is that, not what anyone wants, really.

Think about it: you want to send fifty euros to a friend in another country, or perhaps fifty thousand dollars for a business deal. The amount shouldn't make the process any harder, but for a long time, it truly did. The rules were often unclear, the exchange rates seemed to shift in ways that weren't always in your favor, and the waiting times could be quite long. It was a situation that just felt, in a way, unnecessary. People needed a clearer, more direct path for their money to travel.

This struggle wasn't just for individuals, either. Small businesses, or even bigger ones trying to operate across different countries, faced similar issues. Paying suppliers or getting paid by customers from different parts of the world could become a really complicated dance. It meant more paperwork, more delays, and yes, more of those charges that just add up. So, the need for a better approach, one that simplified these transactions, was very clear for quite some time.

The Frustration Before Hatsek

Before the idea of 'hatsek' started to take hold, people often felt quite frustrated with their options. You might try to send money, and then you'd spend days wondering if it had arrived, or if some new charge had popped up. It was a lack of openness, really, that bothered many. You couldn't easily see what you were paying for, or what the actual exchange rate was at the moment you sent your money. This made planning difficult, and it could lead to some pretty unwelcome surprises.

Imagine needing to pay for something quickly, perhaps an urgent bill or a family need. The traditional systems, they just weren't built for speed or for being truly upfront about costs. It felt like a guessing game, and when it comes to your money, nobody wants to play a guessing game. This feeling of being in the dark, and of being charged too much for a basic service, was a common complaint. It showed that the old ways were simply not keeping up with what people actually needed in a connected world.

The thought of sending money internationally, for many, brought with it a sense of dread. It wasn't just about the money itself, but the mental load of dealing with banks, paperwork, and those long waits. It was clear that a fresh way of thinking was needed, something that put the person sending the money first, making the whole experience feel less like a chore and more like a straightforward task. This is where the 'hatsek' way of doing things truly shines, by taking away that dread.

How Does Hatsek Make Things Easier?

So, how does this 'hatsek' idea actually change things for the better? Well, it's about making the whole process of moving money abroad feel incredibly simple and also very quick. You can send money online in just a few clicks, which is a far cry from the old days of filling out forms and waiting in lines. It's almost like magic, but it's really just smart design and using the right tools to get the job done without fuss. This ease of use is a core part of the 'hatsek' promise.

One of the really nice things about this approach is that you can also ask for and get money directly. It's like having local account details in the most common types of money, no matter where you are. This means someone can pay you as if they were paying a local, which simplifies things immensely for both sides. You get paid easily, and the person sending the money doesn't have to deal with complex international transfer forms. It's a truly straightforward way to manage your funds, you know?

And if you're thinking about making things even smoother, the 'hatsek' concept suggests that linking up your contacts can make the whole process even slicker. Imagine sending money to a friend or family member who is already in your phone's address book, with just a couple of taps. This kind of integration, this focus on making things feel natural and intuitive, is what makes the 'hatsek' way of doing things stand out. It removes those little bumps in the road that used to make money transfers feel so clunky.

Getting Paid Without the Hassle of Hatsek

For businesses, especially those that deal with customers or suppliers in many different countries, the 'hatsek' approach offers a real advantage. You can have an international business account that lets you make and get payments in more than forty different types of money. This means you can operate globally without having to worry about those tricky currency conversions or extra fees eating into your profits. It's about being truly global with your business finances, which is quite liberating, actually.

This ability to hold and move over forty different types of money is a big deal. It means you're not just sending money; you're managing your finances in a way that suits a truly connected world. Whether you're paying an employee in one country or getting paid by a client in another, the 'hatsek' way makes it feel like you're all on the same financial page. It removes the barriers that used to make international business feel so much more difficult than it needed to be.

What's more, the 'hatsek' idea also extends to how you receive payments. You can get paid easily, directly into accounts that act like local ones in various major currencies. This means clients or customers can pay you without needing to jump through hoops, which can definitely help your business relationships. It's about making the financial side of things so much more straightforward, allowing you to focus on what you do best, rather than wrestling with payment systems.

Can Hatsek Really Save You Money?

One of the most appealing aspects of the 'hatsek' approach is its focus on helping you keep more of your money. Traditional banks, as we've talked about, often charge a lot for overseas transfers, sometimes with hidden fees that only show up later. But with the 'hatsek' way, the promise is clear: international transfers without those surprising hidden charges. This transparency is a really big deal, because you know exactly what you're paying upfront, which is very reassuring.

It's not just about avoiding hidden fees, either. The 'hatsek' concept also emphasizes getting good exchange rates. When you're sending money across borders, the exchange rate can make a huge difference to how much money actually arrives at the other end. By offering favorable rates, the 'hatsek' way helps ensure that more of your money gets to where it needs to go, rather than being lost in the conversion process. This can lead to some pretty significant savings over time, especially if you send money often.

Many people have already found that this method works for them. There are, in fact, over 12.8 million people who are quite happy using a system that embodies the 'hatsek' principles. They've discovered that they can send money quickly, at good rates, and with clear, low charges. This large number of users speaks volumes about the effectiveness of this approach. It shows that when you offer something that truly helps people save money and time, they will embrace it.

The Smart Savings with Hatsek

You might wonder, just how much can you actually save with this 'hatsek' way of doing things? Well, the savings can be quite considerable, depending on how often and how much money you move. By cutting out those high bank fees and offering better exchange rates, the difference can add up. It's about being smart with your money, making sure every dollar, euro, or yen you send goes further. This is a key part of the 'hatsek' promise, really.

For example, if you're regularly sending money to family or managing international payments for a business, those small savings on each transfer can become very substantial over a year. It's money that stays in your pocket, or in your business, rather than going into the pockets of financial institutions that aren't being fully transparent. This means more resources for you, for your family, or for your business to grow and do good things.

The ability to find out just how much you can save, often through a simple app or online tool, also makes a difference. This openness means you can compare and see the benefit for yourself, without having to guess or do complicated calculations. It's about putting the power back into your hands, letting you make informed choices about your money. This level of clarity and control is what the 'hatsek' approach aims to provide for everyone who moves money internationally.

What's Next for Hatsek and Global Connections?

The ideas behind 'hatsek' are not just about making money transfers easier; they're part of a bigger shift in how we approach business and technology. Think about how much potential new ways of thinking, like those that involve smart systems, have to make things more effective, spark new ideas, and help things grow. These new ways of thinking are helping businesses, especially newer ones, handle today's complicated business world and turn tough situations into chances for real expansion.

New types of technologies, such as those that manage secure records or those that allow devices to talk to each other, are changing how we do business and how we use technology. These shifts mean that the 'hatsek' way of moving money is just one example of how things are getting simpler and more connected. It's about using clever tools to make everyday tasks, like sending money, feel less like a chore and more like a smooth, automated process.

Smart systems, which include methods that allow computers to learn from data, are changing the landscape for new businesses. They're making it possible for new ideas to take hold, improving how businesses operate day-to-day, and reshaping how companies talk to their customers. The 'hatsek' approach, in a way, uses these same principles to make financial interactions much more straightforward and user-friendly. It's about applying smart thinking to a very practical need.

Looking Ahead with Hatsek

Looking forward, the principles that guide 'hatsek' suggest an even more connected and efficient future. Imagine a world where all your financial transactions, whether personal or business, happen with the same ease and transparency that 'hatsek' offers for international money transfers. It's about using smart tools to make things better, to remove those old barriers that used to slow us down. This could mean even more personalized experiences for users, tailored to their specific needs.

The ability to move money online in just a few quick taps, at truly good rates, is just the beginning. As more and more people experience the benefits of this approach, the demand for similar simplicity in other areas of life will likely grow. The 'hatsek' concept is a clear example of how putting the user first, and using smart, open technology, can lead to solutions that really make a difference in people's daily lives and their financial well-being.

So, whether it's about sending a small amount to a friend, or handling large business payments across continents, the 'hatsek' way offers a better path. It's a way to send money internationally that feels much more honest and much more efficient. It helps you save money, saves you time, and gives you a greater sense of control over your financial movements. This approach really does represent a significant step forward in how we manage our money in a globally connected world.

Anna Hatsek

26 best u/hatsek images on Pholder | Hungary, Europe and Map Porn

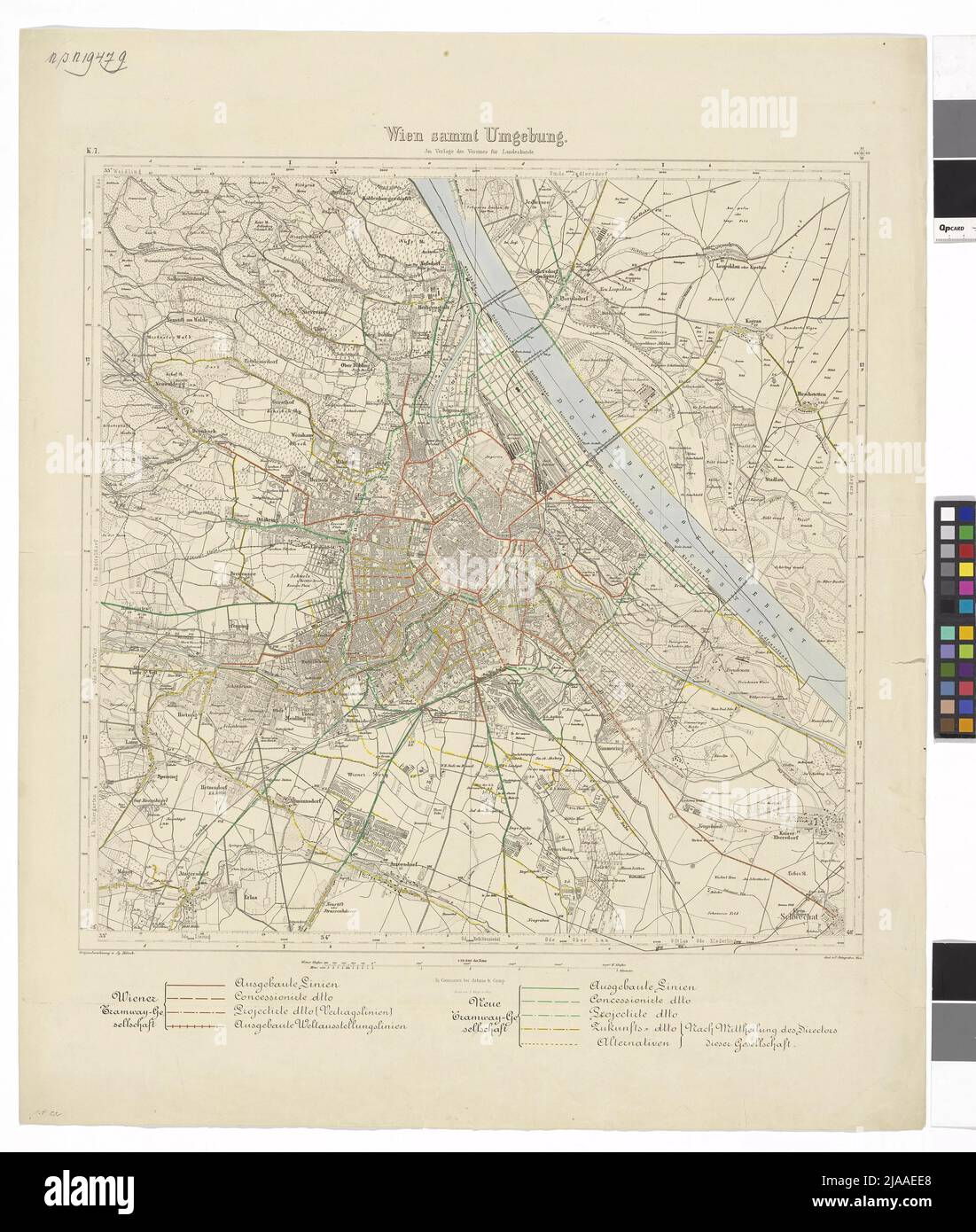

Vienna Samt ". Plan of Vienna with expanded and planned road lines